Whether it’s your first or 10th house, buying a property will always feel like a big win.

I have spoken with young professionals and Nigerians in the diaspora who all said the same thing after buying their first property. “Nobody told me about this part.”

That’s “hidden costs” for you.

The house price you see is never the final amount you pay.

In this article, you will learn about those hidden costs and what to expect.

Table of Contents

ToggleWhat Are Hidden Costs in Nigerian Real Estate?

First of all, hidden costs are not illegal charges.

Most of them are legitimate expenses tied to land ownership, documentation, government approvals, and basic living needs.

They are called hidden because they are rarely mentioned upfront.

For example:

- When a developer says a property costs ₦40 million, many first-time buyers assume ₦40 million is all they need. In reality, that figure usually covers only the structure and land. Everything else comes later.

I once interviewed a buyer in Ajah who paid ₦58 million for a two-bedroom terrace.

By the time she finished paying legal fees, documentation, development levy, electricity connection, and basic renovations, her total spend was close to ₦66 million.

Nothing went wrong. She just did not plan for the extras.

8 Common Hidden Costs When Buying Houses

Let’s now take them one by one, starting with the most important.

1. Legal and Documentation Fees

This is where most first-time buyers are shocked.

Lawyer Fees

You need a property lawyer. This doesn’t mean a family friend who “knows small law.”

A proper property lawyer who understands land titles in Lagos or whichever state you are buying in.

Most lawyers charge between 5 and 10% of the property value. For a ₦50 million house, that could be ₦2.5 million to ₦5 million.

The lawyer handles title verification, deed of assignment, contract of sale, and general due diligence.

Deed of Assignment

This document transfers ownership from the seller to you.

Drafting and execution come with costs. Sometimes it is bundled into the lawyer’s fee. Sometimes it is separate.

Expect to pay a few hundred thousand naira, depending on the property’s value.

2. Governor’s Consent and Land Title Charges

This is one of the highest hidden costs in Lagos and many states.

In Lagos, land technically belongs to the government. Any transfer of ownership requires the Governor’s Consent. The cost can range from 8 to 15 percent of the property value, depending on the land title and current government rates.

For a ₦60 million property, Governor’s Consent alone can cost between ₦4.8 million and ₦9 million.

Many developers advertise “Governor’s Consent in process,” which usually means you will still pay for it later.

- PRO TIP: Always ask this question clearly. Is the consent already perfected and included in the price, or will I pay separately?

3. Survey Fees

If you are buying land or a house without a global C of O, a registered survey plan is essential.

Survey Plan

Survey fees vary by location.

In places like Ibeju-Lekki or Epe, survey plans may cost between ₦750,000 and ₦2 million. In Ikoyi or Victoria Island, it can be much higher.

Charting and Land Registry Search

This confirms whether the land is free from government acquisition or dispute. It is not optional. Charting and searches can cost another ₦200,000 to ₦500,000, depending on complexity. I once followed a case where a buyer skipped charting to save money. Two years later, the land was marked for road expansion.

The house was demolished without compensation.

4. Agency and Broker Fees

Since you’re reading this, I’m sure you already know most Lagos properties involve agents.

Their fees are rarely advertised.

Agency fees typically range from 5 to 10% of the purchase price.

For example:

- If you buy a ₦30 million property, you may need to pay an extra ₦1.5 million to ₦3 million to agents.

Some buyers complain about this, but the reality is that agents control access to many listings. The key is negotiation.

5. Government Charges and Stamp Duties

Stamp duty is required on property transactions. It is usually about 0.5 to 0.75% of the property value. Registration fees also apply when documents are lodged at the land registry. They are unavoidable and often paid long after you’ve gone over the excitement of the purchase.

6. Utility Connection Costs

Depending on your needs, you may need to spend on solar or inverter installations.

Waste management fees are common, too. Some estates charge annual waste fees upfront.

7. Renovation, Finishing, and Fittings

Developers often deliver homes with basic finishing.

You may still need wardrobe and kitchen cabinet upgrades.

But you may eventually spend no dime on this aspect, depending on the type of property. High-end luxury purchases would usually come with all these. Still, budget for finishing even if the house looks complete.

8. Moving and Setup Costs

Many buyers underestimate this phase and drain their savings within weeks of moving in.

- Furniture

- Moving trucks

- Security deposits

- Internet installation

- Minor repairs

All these add up quickly.

Common Mistakes First-Time Buyers Make

The biggest mistake is assuming the house price is the total cost.

Some even go as far as:

- Trusting verbal promises

- Skipping legal checks

- Exhausting their entire savings on the purchase alone.

It never ends well.

Do This to Avoid Hidden Charges

First, ask for a written full cost breakdown.

You also want to hire your own lawyer, not the seller’s lawyer.

It is better to set aside at least 20% of the purchase price for additional costs.

Ultimately, working with a registered and reliable realtor makes life easier.

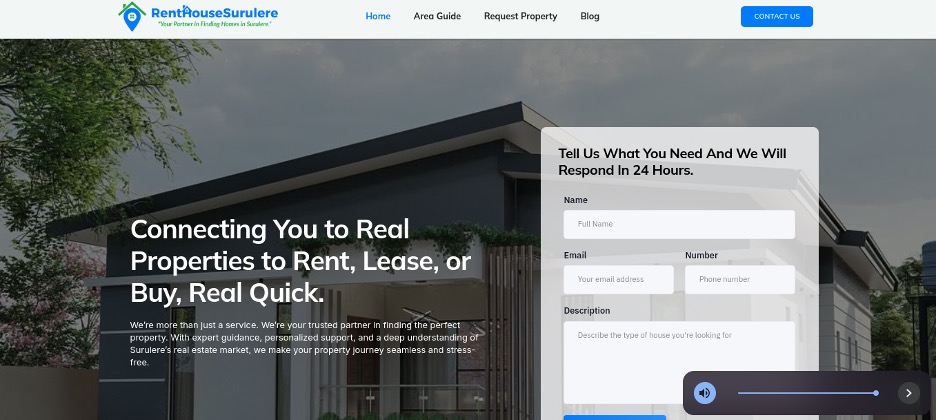

Reliable Property Realtor in Lagos: RentHouseSurulere

At RentHouseSurulere, we understand the risks involved in buying or selling land in Lagos. That’s why we’ve built our entire business around trust, transparency, and verified processes.

Here’s how we operate:

- Legal Approach: Every property we list undergoes a thorough background check, which includes title verification, ownership validation, and a review of legal documentation.

- We’re registered: We’re registered with LASRERA and work hand in hand with certified lawyers, registered surveyors, and accredited valuers.

- Convenience for you: We offer virtual property tours, video calls, and secure digital agreements, allowing you to buy with confidence from anywhere.

- Transparent deals: All transactions are routed through our official, verified company accounts and never through personal accounts or agents.

- Social Proof: Our website and social media channels give you access to real estate guides, blog articles, and expert interviews.

Our happy clients, glowing reviews, and repeat referrals demonstrate that when it comes to real estate in Lagos, RentHouseSurulere is the name you can trust.

Looking to buy a property? You can start by sending us a simple Whatsapp message.