There’s a point you get to where you realize you don’t have any real estate property to your name, and it’s not due to a lack of wealth.

In reality, the bigger problem is the lack of a clear savings plan.

It’s not until you have billions in your bank account that you fulfill your dreams.

In the next five minutes, you will learn:

- Practical steps to save steadily for property

- Apps and platforms that realistically help

- Mistakes many first-time property buyers make

- Ideal property type worth buying as a first-timer.

Even many 9-to-5ers and middle- to low-income earners use these methods to buy houses and land conveniently over time.

Table of Contents

ToggleHow to Save For Your First Property

Many first-time buyers rush into deals because of pressure or fear of missing out.

They later discover that owning property is more than just paying the purchase price.

Step 1: Understand How Much Property Really Costs in Lagos

Before you start saving, you need a clear idea of what you are saving for. Many people save blindly without a target. That often leads to frustration.

Property prices in Lagos vary widely depending on location, title, and type.

For example, typical full residential plots (500–600 sqm) ask between ₦100 million and ₦300 million, depending on locality.

ALSO READ: Where to Find Cheap Houses To Buy in Surulere (Under ₦200m)

As a first-time buyer, you should answer these questions honestly.

- Do you want land or a house?

- Are you buying to live in or to hold for the future?

- Do you prefer the mainland or the island?

- Are you open to developing areas or do you want a mature location?

Once you answer these, research average prices in your chosen areas. Talk to verified real estate agents in Lagos.

Also, your savings target should include both the property price and additional costs (about 30% above the property value for documentation and fees).

Step 2: Assess Your Current Financial Situation Honestly

Sit down and look at your income. Look at your monthly take-home pay and any extra income you earn.

Then look at your expenses (rent, food, transport, subscriptions, family support, lifestyle spending, and everything else).

Many people think they cannot save, but when they track their spending properly, they discover small leaks that add up over time.

Write everything down. Use a notebook, spreadsheet, or budgeting app. What matters is consistency.

For example, look at this one:

Once you know your numbers, you can decide how much you can realistically save every month without struggling.

Step 3: Set a Realistic Savings Goal

Saving without a target is like traveling without knowing your destination.

Let us use an example.

Imagine you want to buy a small plot of land in a developing area of Lagos that costs ₦200 million. Additional costs bring the total to ₦210 million.

To be realistic, you can’t say you want to plan to buy it within three years with monthly savings.

The property may not be available by then. Even if it is, the value must have gone up.

That means you need to focus on property deals that allow a DOWN PAYMENT of a fraction of the price.

That way, you can save for the initial deposit, then pay monthly after acquiring the property.

For Example:

Let’s say a 3-bedroom fully detached house off Adelabu is going for ₦260 million.

The deal may include an initial deposit of N20 million and the option to spread the balance over 12 months.

That way, you can save for the N20 million naira initial deposit.

Another strategic approach is to save for the long term, aiming for over N100 million, depending on your monthly income.

At maturity, you can now look for a property within the range you’ve saved.

Step 4: Open a Dedicated Property Savings Account

One of the biggest mistakes first-time buyers make is mixing property savings with everyday money.

If your savings sit in the same account you use for daily spending, temptation will always win.

Open a separate savings account strictly for your property goal.

There are options such as:

- Fixed deposit account

- Digital saving platforms (Piggyvest, Cowrywise, etc)

Choose what works for you, but make sure access is not too easy.

Give the account a name that reminds you of your goal (something like My First Lagos Property or Home Fund)

Step 5: Automate Your Savings If Possible

Saving manually every month requires strong willpower. Life happens.

If you can, automate your savings.

Set up a standing order or automatic transfer that moves money into your property savings account as soon as your salary drops.

This way, you save before you spend. Even if the amount is small at first, consistency matters more than size. People who automate their savings are far more likely to reach their goals than those who rely on motivation alone.

Step 6: Increase Your Income to Speed Up Saving

If saving is the watchword, there’s no better approach than to increase income.

- Can you take on freelance work?

- Can you offer a skill online?

- Can you start a small side business?

- Can you ask for a raise or switch roles?

I’ve spoken with many people who fund property savings through side hustles.

Even an extra ₦500,000 or ₦1 million per month can significantly shorten your saving timeline.

Again, Consider Flexible Payment Plans for Properties

Some Lagos developers offer installment payment plans for land or houses.

These can help first-time buyers, but they require caution.

Payment plans usually involve higher total costs than outright purchases. Some also have strict penalties for default.

If you choose this route, read everything. Ask questions. Understand the schedule and penalties.

Also, make sure your income can support the payments without stress.

Do not rely on uncertain future income. Property commitments should be based on money you already earn, not money you hope to earn.

- DID YOU KNOW? At RentHouseSurulere, we offer many flexible payment plans for property purchases. You can reach us on WhatsApp, and we can share which ones are currently available.

Mortgage and Housing Finance Options

Mortgages in Nigeria are not as standard as in some other countries, but they exist.

Some banks and mortgage institutions offer home loans with varying terms. Interest rates, tenure, and requirements differ widely.

As a first-time buyer, educate yourself early. Understand what is required, how much deposit you need, and how monthly repayments work.

- Most lenders require a 20%–30% equity contribution (down payment).

- Interest rates range from 17% to 25% per annum, depending on the tenure and borrower profile.

- Tenure typically ranges from 10 to 20 years.

ALSO READ: How To Get A House on Mortgage in Lagos

Common Mistakes First-Time Buyers Make When Saving

One major mistake is underestimating costs.

Another is rushing into deals because of pressure. Some people also rely too heavily on verbal promises or informal agreements.

Another common error is saving without learning. While saving, educate yourself about land titles, documentation, and common scams in Lagos.

Ultimately, working with the right real estate agent can make or mar your goals.

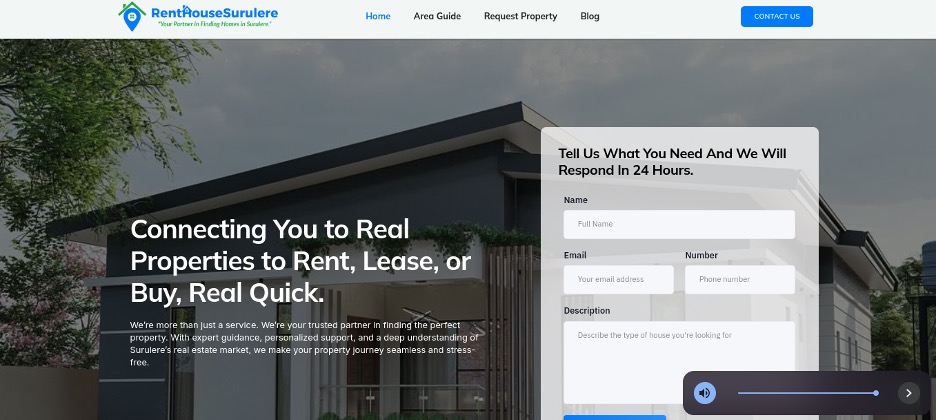

Buy Affordable Properties in Lagos with RentHouseSurulere

If you’re looking to buy any property in Surulere, the easiest and fastest way is to use the ‘Request Property’ feature on RentHouseSurulere.

- Proudly Registered: We are proud to be a fully registered and certified real estate agency with Lagos State Real Estate Regulatory Authority (LASRERA). This means we operate legally, transparently, and in full compliance with Lagos State’s real estate laws.

- Zero Inspection Fees: Unlike traditional agents, who may charge ₦5,000 to ₦10,000 per property inspection (often with no guarantee of quality), we offer three free inspections.

- Transparent Process: You’ll always know how much property and agency fees cost, all of this before inspection. We deal directly with sellers and landlords, so there are no surprises. We clearly present the landlord’s terms, and you receive a receipt for each payment.

- Verified Listings: We only upload listings that we’ve personally inspected. We update our listings regularly so you don’t waste time chasing unavailable houses.

- It’s Fast: If you’re in a hurry or prefer chatting or calling, simply message us on WhatsApp.

We’ll reply faster than you expect, usually with ready-to-go apartment options, photos, videos, and even personalised advice on which areas in Surulere are most suitable for you, based on your lifestyle and budget.