If there’s one thing I’ve learned covering the Lagos property market for over 5 years, it’s that Nigerians don’t all buy property the same way.

You may not realize it quickly, but your year of birth often determines where you buy, how you pay, who you trust, and the risks you’re willing to take.

We’ve seen the era of handshake agreements and family land.

We’re now in the era of Instagram ads and fractional ownership platforms.

The point is, each generation of Nigerians has its own property-buying logic.

If you hang on for a minute, I’ll show you how in this article.

Table of Contents

ToggleNigeria’s Property-Buying Generations: Quick Look

First off, let’s group Nigerian buyers into four cohorts:

- Baby Boomers (born before 1965)

- Generation X (1965–1980)

- Millennials (1981–1996)

- Generation Z (1997 onwards)

Each group buys property differently.

It’s not even because they want to, but because their economic realities forced them to.

You still don’t agree?

1. How Baby Boomers Buy Property

Most Nigerian Baby Boomers bought property before land became a luxury asset.

In the 1970s and early 1990s, it wasn’t unusual for a civil servant or trader to buy land outright, and payments were often:

- Full cash

- Paid in instalments directly to landowners

- Based on trust and community reputation

We’re talking about folks who are now 60-70 years old.

You will look at them and notice the key characteristics in their property purchase are:

- Heavy reliance on family land

- Minimal (or no) documentation at purchase (thankfully, that has changed)

- Properties held for decades, not flipped

Many Boomers still own land they bought cheaply that is now worth hundreds of millions (with a sprinkle of documentation problems surfacing every now and then).

The common problem faced by many Baby Boomers in their purchase style today is:

- Their children discover that the land was never appropriately titled

- The land was sold by only one branch of a land-owning family.

2. How Generation X Buys Property

Generation X sits in the middle.

And, you can see it clearly in their buying behavior.

How they typically buy:

- A combination of cash and small loans

- Buying land for both use and inheritance

- Preference for bungalows and duplexes

- Early adopters of estates and gated communities

I’ve worked with Gen X buyers who bought land in Ajah or Magodo in the early 2000s and then built gradually over 5–10 years

Also, it seems to be very common for this group to regularise titles after construction.

They are also the generation that began to formalise inheritance planning, though many still leave things undocumented.

3. How Millennials Buy Property

The birth year saw the arrival of presidents and heads of state such as Shehu Shagari, Muhammadu Buhari, and Sani Abacha.

This group is the most anxious property buyers I’ve encountered, and for good reason.

They entered adulthood during:

- High unemployment

- Currency devaluation

- Rising land prices

- Weak mortgage systems

With that in mind, I don’t get surprised when Millennials want to buy property and fall into any of these:

- Off-plan purchases

- Developer payment plans (12–36 months)

- Smaller plots or apartments

- Heavy use of agents, Instagram, WhatsApp, and property portals

We’re talking about Nigerians aged 30 to 44 here.

I’ve even seen Millennials buy property they’ve never physically visited (something older buyers would never do).

They ask more questions, request documents early, and Google everything (which is good).

4. How Gen Z Buys Property

This one is perhaps the most interesting group today.

First of all, there’s the age factor. Today, Nigerian youth aged 18 to 28 have challenged the means of accumulating wealth.

So you could have people in this demographic who are who are rich enough to own property.

But generally, many can’t afford it. What I’m seeing on the ground:

- Fractional ownership

- Co-buying with friends or siblings

- Micro-units and studio apartments

- Long-term rent-to-own models

When it comes to buying properties in Nigeria, Gen Zs are comfortable with Apps, digital contracts, online verification tools, and following the advice of property content creators on Social Media.

Their challenge is usually experience.

You disagree?

Tell me the last time you saw a Gen Z property buyer online calling out a platform or company for a real estate gimmick? More often, I suppose.

Buying Properties in Nigeria Today: What Every Buyer Must Check

Regardless of age, these documents matter:

- Certificate of Occupancy (C of O)

- Governor’s Consent

- Deed of Assignment

- Registered survey plan

- Excision or Gazette (for family land)

We’ve apparently moved away from the era of relying solely on just developer branding or “na my person get the project.”

Always verify independently.

Common Property Scams by Generation

I wouldn’t call this something you should generalise. But based on the analysis so far, it’s not far-fetched to see that the following land scams are more peculiar with certain generations over others:

| Generation | Common Property Scam Targeted at Them |

| Boomers | Trusting family connections blindly |

| Gen X | Delayed documentation |

| Millennials | Off-plan developer defaults |

| Gen Z | Fake fractional real estate platforms or deals. |

All these scams evolve. But no generation is entirely immune to any of the above-listed tricks.

What This Means for Agents and Developers

One thing is clear. When it comes to buying real estate, the Nigerian buyer is no longer one-size-fits-all.

As a developer, you need to identify your target market for an apartment, facility, or property.

- Older buyers want stability and land.

- Younger buyers want flexibility and entry points.

Also, Nigerians of all generations are now doing things digital. So, trust in your real estate brand is now built digitally.

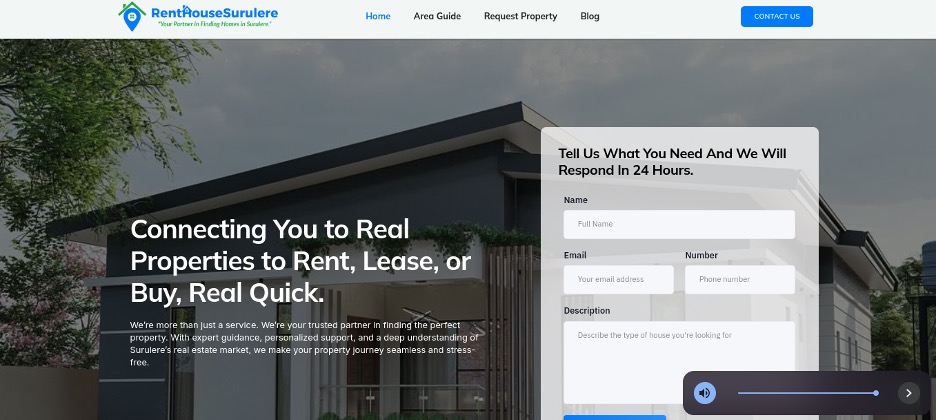

At RentHouseSurulere, we understand that ignoring generational psychology is bad business.

No Matter Your Taste: Buy Reliable Properties With RentHouseSurulere

If you’re ready to explore real investment opportunities in Surulere, start with a property agent.

At RentHouseSurulere, we’ve helped dozens of clients secure profitable assets across Lagos, and the trend continues to be upward.

Our system is designed for busy property buyers like you who want results.

And that process is handled by a team that knows how to find deals in Surulere and across Lagos, because we are locals too.

Send us a WhatsApp message today, and let’s help you find your dream property faster.