One of the crucial steps in buying or selling a property is the title transfer.

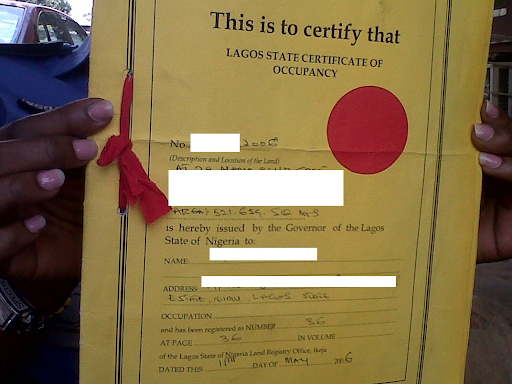

A property title is the legal documentation that proves ownership or interest in a piece of land.

Without a valid title, you could lose your investment or become entangled in legal disputes.

What is the cost of a proper title transfer? We frequently receive this question during consultations.

This article covers all you need to know.

Table of Contents

ToggleKey Takeaways

- Title transfer often costs 4–5% of the property value in Lagos.

- The buyer usually bears most of the title transfer costs

- Bureaucratic hurdles can delay the entire process for months.

- At Rent House Surulere, we help you connect with real estate buyers and sellers in Lagos, providing expert guidance and personalized support.

Why Title Transfer Costs Matter

When you purchase a property, the price you agree is only part of your total outlay.

Title transfer costs often add 5% or more above the sale price, depending on location and property value.

Underbudgeting leads to delays, failed closings, or sellers walking back because “the extra cost is too much.”

For sellers, these costs influence how much net you’ll receive. Smart parties understand all fees first, then negotiate.

Getting title transfer right means:

- Your ownership is legally recognized

- Your title is protected against future claims

- You can resell, mortgage, or develop freely

- You avoid penalties or fines.

Title Transfer Costs in Lagos For Properties in 2025

| Titles | Cost | Who Often Pays |

| Governor’s Consent (Consent Fee) | 1.5% of the property value | Buyer (often) |

| Registration Fee | 0.5% of property value | Buyer |

| Stamp Duty & Deed of Assignment | 1.5% (for deeds) | Buyer |

| Capital Gains Tax (CGT) | 0.5% (in context of consent) | Seller (can be negotiated) |

| Survey or Valuation or Plans | Fixed and variable (e.g. ₦100,000s) | Buyer |

| Legal / Conveyancing Fees | 1%–2% (can be negotiated) | Buyer or split |

| Searches, CTCs, Ground Rent, Charting, Admin | Fixed or a small percentage of the value | Buyer |

Please note that these rates are based on inquiries from the official channels, such as the FIRS Stamp Duty Service.

You can still request a demand notice from the Lagos State Land Bureau or your conveyancer to get exact amounts.

For better context, let’s use a fictional property in Surulere that is being sold for ₦500 million.

Example: Title Transfer Cost for N500m Property

Assuming the property purchase price for a property is ₦500,000,000, the title transfer cost will be as follows, based on the current percentage rate:

- Consent = ₦7,500,000

- Registration = ₦2,500,000

- Stamp duty = ₦7,500,000

- Legal & survey = ₦3,500,000

Total ≈ ₦21,000,000 (4.2% of the purchase price)

You see that, across values, title transfer often costs 4–5% of the property value in Lagos.

And, it really depends on legal fees and complexity.

Who Pays What? Buyer vs Seller

In Lagos, by custom and practice, the buyer typically bears the majority of the costs of title transfer. This includes consent, registration, stamp duty, survey, and legal fees.

In more precise terms, here’s who pays what:

Buyer’s Costs in the Title Transfer Process

- Stamp Duty: Paid on the sale agreement, based on the property’s value.

- Registration Fees: To officially register the Deed of Assignment with the authorities.

- Survey Fees: To verify the property’s location and size.

- Governor’s Consent: A fee for the government’s approval of the transfer.

- Legal Fees for the Buyer’s Lawyer: For drafting and negotiating completion documents.

Seller’s Costs in the Title Transfer Process

- Capital Gains Tax (CGT): A tax on the profit made from the property sale, typically paid by the seller.

- Estate Agent Commission: If applicable, the seller pays the agent for facilitating the sale.

- Legal Fees for the Seller’s Lawyer: To manage the legal process.

Some sellers may absorb parts (especially legal preparation) as negotiation points, but that’s the exception.

When negotiating, clarify in your sale agreement who pays what, and insist on a demand notice listing each fee so there are no “surprise extras.”

Step-by-Step: How Title Transfer Works in Lagos

It’s one thing to know the costs of these title transfers; it’s another to understand how the process works. It begins with due diligence.

With the right property lawyer, you’d typically have all these covered:

Step 1: Preliminary due diligence

From the buyer’s perspective, you have to verify the seller’s title (C of O, deed, survey plan, any encumbrances)

Request certified true copies (CTCs) and confirm they match land registry records.

Part of the first stage also involves engaging a qualified conveyancer to conduct title searches and identify any issues.

Step 2: Draft and sign Deed of Assignment

The deed formally transfers ownership from the seller (assignor) to the buyer (assignee).

It includes the property description, the agreed consideration, and the parties’ details.

Step 3: Apply for Governor’s Consent

Because all land in Lagos is held by the Governor under the Land Use Act, for any transfer of existing titled land, you must get his (or her) consent.

This involves submitting documents such as a deed draft, a survey plan, a valid ID, tax clearance certificates, payment receipts, and so on.

Step 4: Stamp the Deed

After consent is granted, you’ll now pay stamp duty on the deed.

Without stamping, the document is inadmissible in court and cannot be registered.

We usually recommend that you don’t pay stamp duty before consent is confirmed.

This is because if consent is declined, you can’t always recover duties.

Step 5: Register at Land Registry (Lagos State Registry)

With the stamped deed and consent in hand, present to the registry.

They will register the property in your name, update records, and issue new title documents.

Registration ensures priority and public notice of your ownership.

Step 6: Post-registration checks

Once registered, retrieve your issued title, file it properly, and ensure you have all receipts. Also, verify that your name appears in the registry logs.

How Long Does Title Transfer Take? Delay is Usually an Issue

You really can’t predict when these things get processed.

For example, Governor’s Consent processing in Lagos can take between 30 days and 6 months, or even a year.

Although the official expected timeframe is 30 days, the reality is often much longer due to bureaucratic hurdles.

Even stamping and registration processing in Lagos typically takes at least 3 months.

Finally, Watch Out For Red Flags

If you’re the buyer, keep your eyes open for any ‘funny’ activity.

Once you notice any of the following, it’s better to stop the transaction and consult a land lawyer:

- The seller demands “flat extra fees” outside the demand notice

- The titles do not match registry records

- The survey plan doesn’t match the physical site

- The seller is unwilling to apply for consent officially

- They are requesting you to pay the stamping before consent is confirmed

- Fake or forged CTCs, or forged signature of the assignor

By the way, if the property type is Land, you should be more careful during the title transfer process, as there are many potential red flags to look out for in scams.

READ ALSO: How to Avoid Land Scam in Lagos 2025: Legal Tips & Red Flags

*We’re not legal practitioners or a government agency. All information provided in this post is through research and our sales experience in the Lagos property market.

FAQs

Is the Governor’s Consent always required?

Yes. For any resale or transfer of land/title in Lagos. Without it, your transfer is legally invalid.

When must stamp duty be paid?

After consent is granted (not before), an unstamped deed cannot be registered and is inadmissible in court.

Can the seller pay CGT?

By law, CGT is technically the seller’s liability, but parties often negotiate who pays it in the sale agreement.

What if Lagos changes rates mid-process?

The demand notice locks in the rates. Always use a current demand notice for your transaction.